Overview

Jackson is a Fortune 500 retirement planning company with total assets reaching $315 billion. To help customers plan and save for their retirement, Jackson developed an educational offering encouraging advisors and their clients to set financial goals. To broaden its reach, Jackson partnered with Think Company to discover and conceptualize how to best facilitate the new offering digitally.

Industry

Company Revenue

$14B+

Research to inform UX and content strategy

We took a mixed-methods approach to our design research, learning from financial advisors and their clients. We started with a survey to gather feedback on the program from a broad group of customers. Diving deeper, we observed workshops and facilitated in-depth interviews with customers by age and other segmentations that helped us understand what retirement preparedness means and what is missing in the landscape of retirement products and services.

A service design lens for the retirement journey

With our research insights, we mapped the advisor and customer experience for this program in the context of the broader retirement planning journey. Since this is one of many programs and services that financial advisors can use with their clients, a journey map helped identify any gaps in the program and opportunities to better integrate the program into the overall retirement planning experience.

Understanding key inflection points in the

user experience

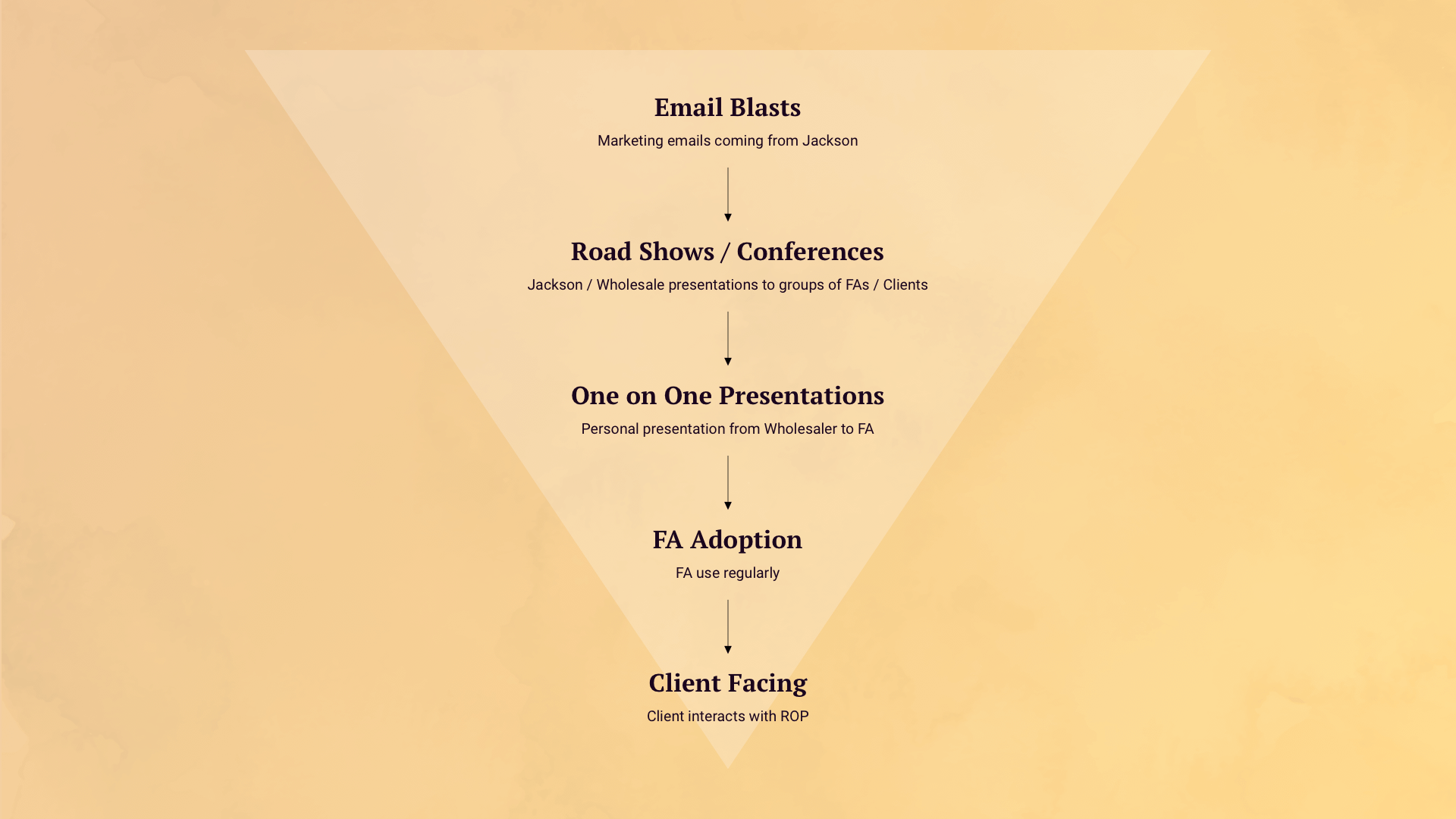

We learned that a communication funnel was key to the overall success of the program and that it was important to overcome barriers at each phase, sequentially. We created a framework to articulate these phases and barriers that include awareness, consistency of message, adoption and training, and product integration.

Improved communication and platform adoption

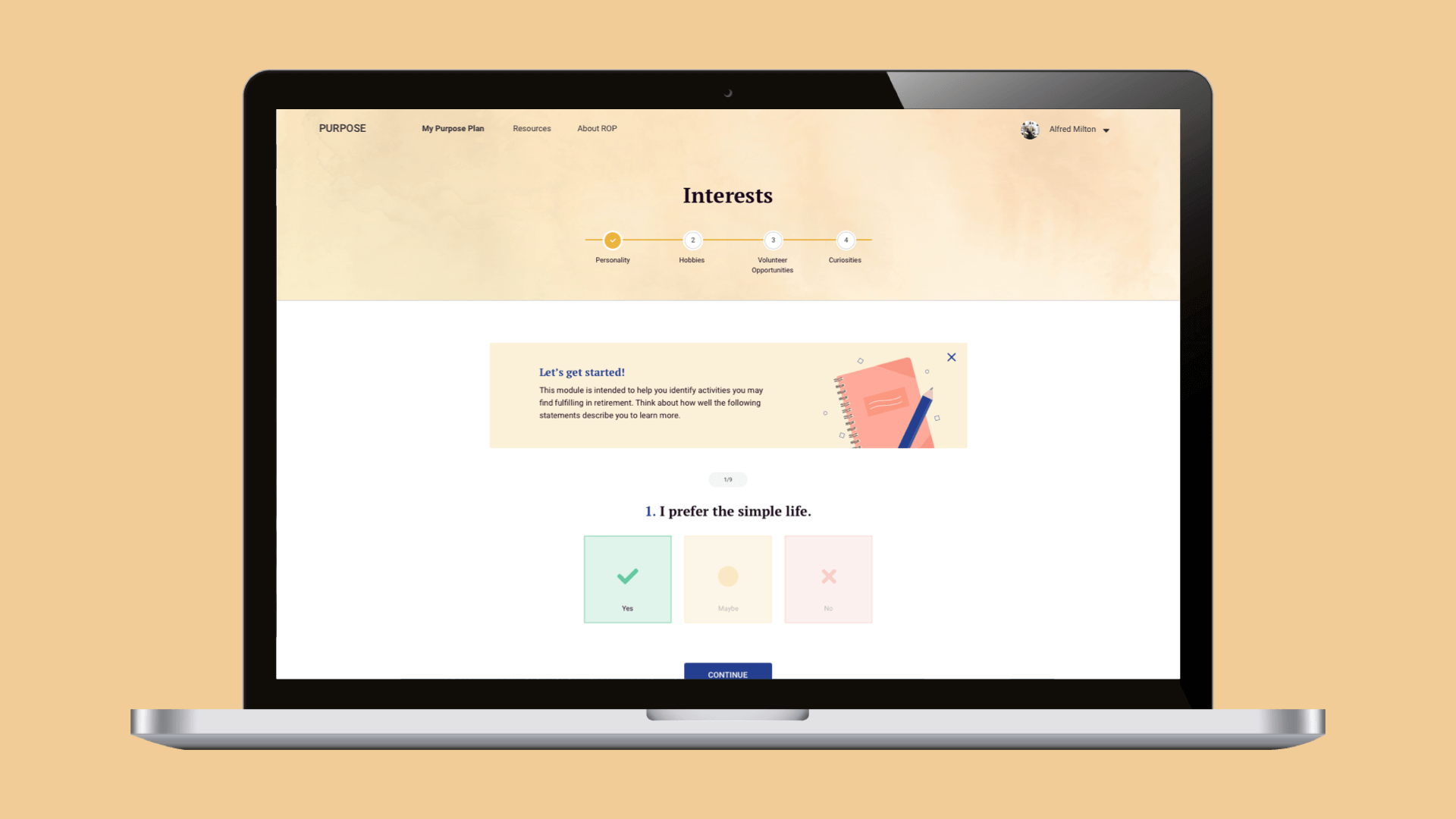

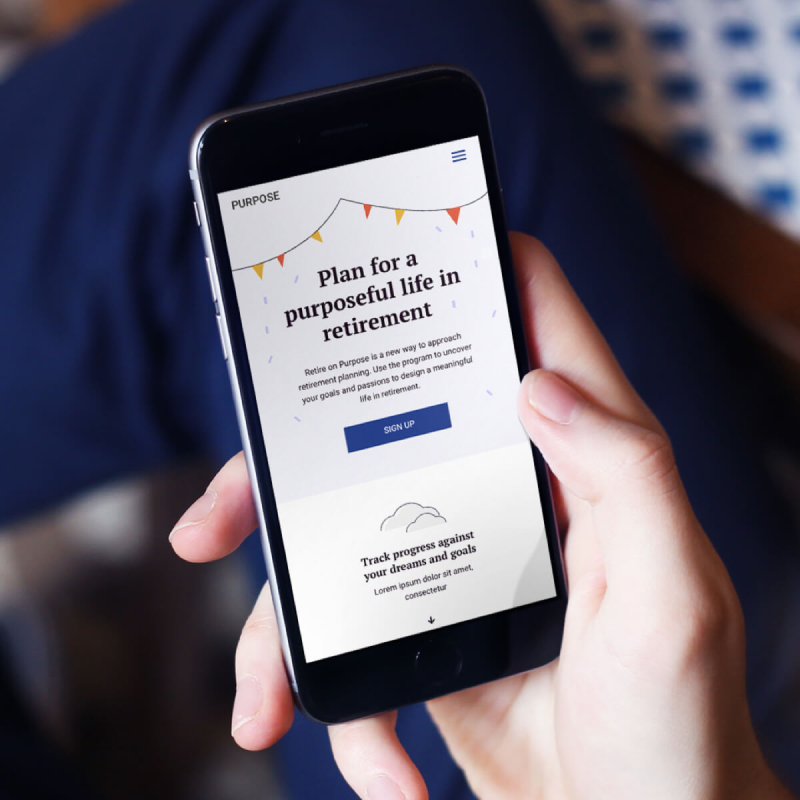

Our design research surfaced opportunities for Jackson to improve and evolve the communication and distribution of the program at each phase of the process. This included content improvements by providing more concise and action-oriented information. Additionally, we designed a testable prototype for financial advisors. This starter-kit will support them by showing clear pathways for customer learning and adoption.

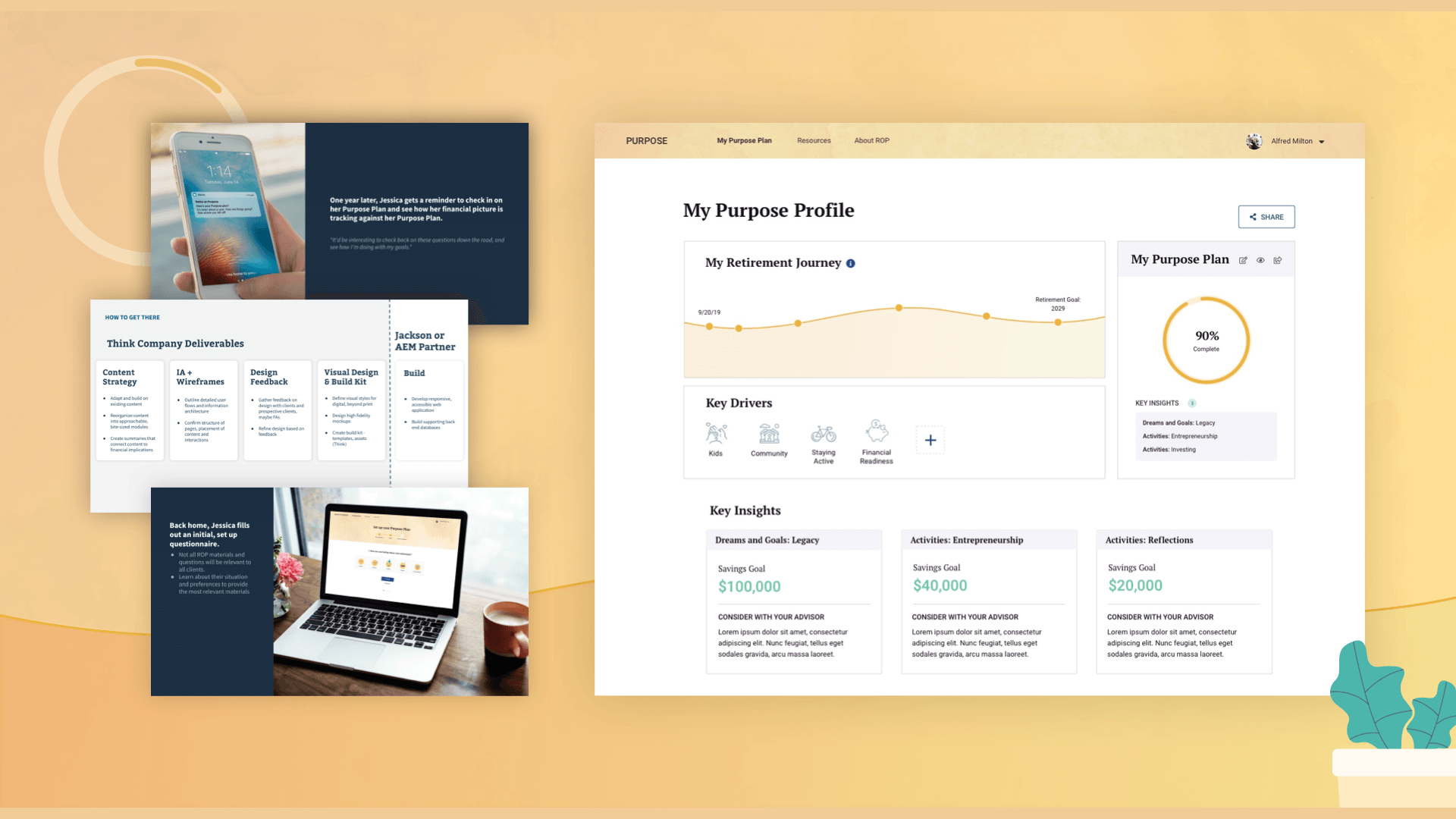

Strategy and visioning for organizational buy-in

As is often the case, our partners had to communicate these ideas to internal stakeholders including company executives. We supported them by creating a presentation that shared the future vision for a new customer experience. This helped them clearly communicate the core recommendation and value in a simple and compelling way.

User-centered retirement services through design research

Our research gave Jackson a clear picture of how customers and agents use their content and evaluate their products. With these learnings and the design concepts we provided, Jackson is prepared to build tools that better service these audiences.